Graphic of the Week

Fossils Live as Investors Pour $7 Billion into Emerging E&P Technologies

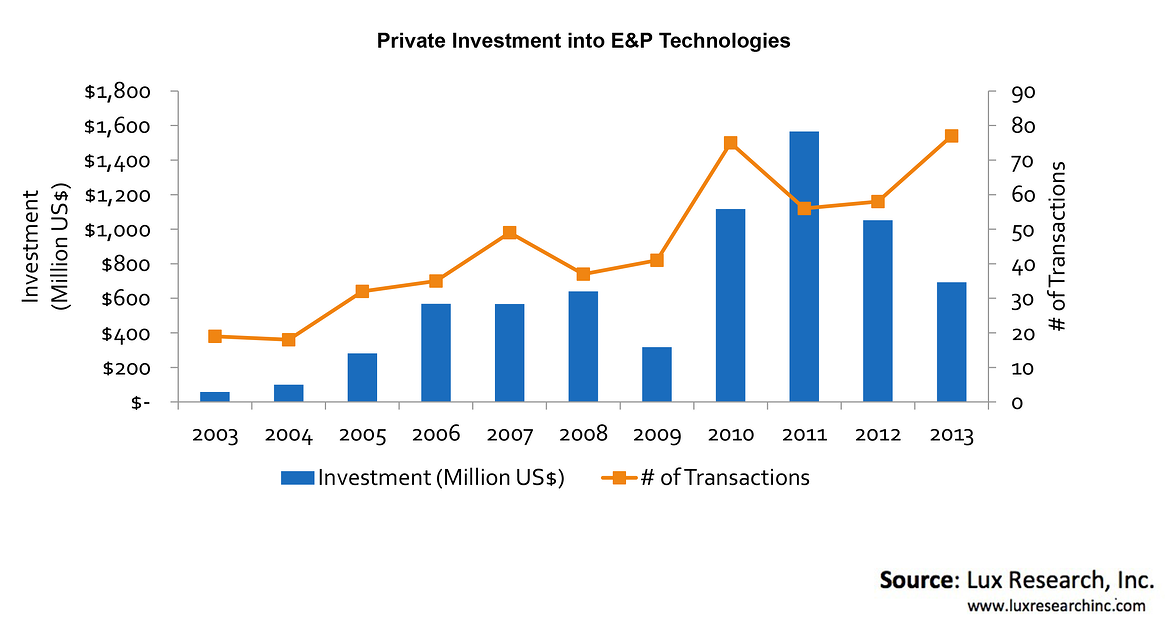

Although the oil and gas industry has taken a conservative stance on emerging technology for decades, recent challenges in the upstream and midstream sector have initiated a wave of new opportunity for technology developers. The numbers don’t lie. Investment into emerging E&P technologies were nearly non-existent in 2003, at just $57 million. Since then, E&P technologies have attracted nearly $7 billion in private investment from 497 unique transactions. Of course, the financial crisis curbed investments in 2009, but the industry bounced back quickly, reaching $1.6 billion in 2011.

Some might look at the numbers and conclude that investment is now on the decline again from 2011’s peak, but there is nuance underneath the overall total investment year by year. In that peak year in terms of dollars, $866 million went to a single startup, Laricina Energy, and its process involving solvent-cyclic steam assisted gravity drainage (SC-SAGD) to boost production of bitumen from Canada's oil sands. Just as importantly as an overarching trend, the number of transactions continues to rise, to a record of 77 unique transactions in 2013. Not surprisingly, North American start-ups have attracted 76% of transactions (377) and 87% of investment dollars ($6 billion) since 2003 due to the booming heavy oil and tight oil/shale gas market. European companies have also raised significant funding, with $770 million from 107 transactions. The evolving deepwater sector, primarily driven by North Sea assets, has driven investment into Europe’s oil and gas start-up community. This is particularly true in Norway, which accounts for about 55% of Europe’s investment activity.

The exits have also been flowing. While there are many oil and gas operating companies that go public, technology developers in E&P rarely have an initial public offering. The most common exit strategy for technology developers is acquisition by oilfield services companies. Summing these up, there have been 136 acquisitions between 2003 and 2013. Schlumberger is the most prolific buyer, having acquired 56 E&P technology developers since 2003. Private equity firms have also purchased technology companies, but with the end goal of turning them around to sell to an oilfield services company. In the near term, a brief acquisition respite is likely as oilfield services companies have struggled to grow their EBITDA since 2011. Weak natural gas prices (and, more recently, weak oil prices) along with increasing competition and a shorter drilling season due to weather in North America have hurt the major oilfield services companies.

Oilfield services companies will continue to acquire new technologies over time, and so investors should consider engaging with innovative companies that are actively fundraising. Companies like Acoustic Zoom and Robotic Drilling Systems (RDS) offer significant value over incumbent processes. Acoustic Zoom’s concentrated acoustic beams provide imagery of the internal character of geological formations not possible with conventional seismic. RDS is developing a robotic drilling rig that may ultimately reduce costs by about $9 million per year.

Source: Lux Research report "Investing in Next Generation Oil and Gas Technologies" -- client registration required. To learn more about this graphic and related intelligence from Lux Research, click here or email Carole Jacques.

Analyst Insights on Lux Populi this week

Energy Electronics: Mitsubishi Electric's Latest SiC Addition Shows that it is still Pursuing an Unfocused SiC Strategy

Mitsubishi Electric has announced it will have a hybrid silicon carbide (SiC) dual in-line package intelligent power module (DIPIPM) available for customers at the end of November 2014. DIPIPMs are intended to decrease power usage and offer circuit protection for end applications like solar inverters. Mitsubishi Electric's modules consist of a SiC Schottky barrier diode (SBD), a silicon insulated gate bipolar transistor (IGBT) with a carrier stored trench-gate bipolar transistor (CSTBT) structure, and a low-voltage integrated circuit (LVIC). The claimed benefits of the CSTBT structure include lower on-stage voltage, improved short-circuit ruggedness, and reduced drive power over conventional IGBTs. The company says that the DIPIPM reduces power consumption of inverters by 25% compared to the company's previous line of DIPIPMs. The module also has a current-sensing pin that can be used for short-circuit protection and offers control power supply under-voltage protection. The power modules are rated at 50 A and 600 V and come in a 31 mm x 79 mm x 8 mm package.

Mitsubishi Electric continues to add SiC power modules to its portfolio of products (client registration required), but it is creating modules based on ease of translating to SiC rather than looking for a demand in SiC. As a result, its SiC portfolio lacks focus and direction. For instance, this new module only uses SiC for its SBD and still uses a silicon IGBT which bottlenecks the switching efficiency of the module, instead of trying to use a SiC metal oxide semiconductor field effect transistor (MOSFET) that would be sure to increase power efficiency. In contrast, Cree's targeted approach led it to be first to establish its line of SiC discrete and is now hand-holding its customers in using SiC power modules instead of waiting for a customer base to appear (client registration required).

The company's 25% decrease in power consumption is commendable; however, this power saving may be easily matched through cheaper gallium nitride (GaN)-on-silicon power modules (see the report "Reaching For the High Fruit: Finding Room for SiC and GaN in the Solar Inverter Market" -- client registration required), which are being released by GaN companies like Transphorm (client registration required) in the near future. Mitsubishi should focus its efforts on scaling its SiC MOSFET production, and then produce high-voltage modules, where GaN competitors cannot play. Mitsubishi may also find that Cree's strategy of hand-holding customers to use SiC modules may help them gain market share and find directions for its products that are the most desirable to customers.

Energy Storage: German Companies Shake up Their Energy Storage Strategies Yet Again

Three German companies are shaking up their energy storage strategies as they try to adapt to an evolving battery landscape: Automotive OEM Daimler is exiting the lithium-ion (Li-ion) battery manufacturing business, Tier 1 supplier Continental is trying to back out of its Li-ion joint venture with South Korean player SK Innovation, and materials giant BASF is striking up new partnerships with Toda Kogyo and EnerG2.

Daimler's exit is not surprising: The Li-Tec joint venture it formed with Evonik has been unprofitable because of an unfortunate combination of poor Daimler plug-in vehicle sales and tough competition from other Li-ion developers (client registration required). The resulting low volumes meant that Li-Tec's batteries are simply too expensive, so rather than making its own cells, Daimler has now decided to buy them from the larger supplier LG Chem. The German OEM took too long to cut its losses: Li-Tec has been in business for six years, losing money all along, yet earlier this year Daimler actually doubled down by buying out Evonik's share. Now, half a year later, Daimler has decided to stop making Li-ion cells altogether, and plans to wind down production by the end of 2015. It will assemble packs using others' cells, so the effort is not a total loss (it can reallocate some of its cell workforce to make packs for example); nonetheless, its experiment with Li-ion cell production has proven to be a very expensive lesson in when to outsource.

Continental, on the other hand, is moving quicker to cut its losses: Its battery joint venture (client registration required) is three years old, and the German Tier 1 supplier is now looking to exit because of slow demand. Continental also recently wrote down about $100 million of the joint venture's value. Painful as it may be, the move is the right one: SK-Continental does not have what it takes to break into the very consolidated leaderboard for automotive batteries, where Panasonic, LG Chem, and a handful of other players rule by virtue of scale and partnerships (see the Automotive Battery Tracker -- client registration required.) It is unclear at this point whether SK-Continental's interesting work on 48 V advanced micro-hybrids (client registration required) may be a victim of this move, or whether each will continue this development independently from now on.

Against this backdrop of failed partnerships, BASF's most recent moves provide a refreshing change of pace, for two key reasons. First, these moves are backed by a much broader commitment, with BASF identifying energy storage as one of its top 10 areas for research and long-term growth, and funding it accordingly. Second, these moves indicate a multi-faceted strategy – rather than a single bet, BASF is comfortable to invest in evolving Li-ion technology, into new materials for batteries and supercapacitors, and even into wholly next-generation approaches like lithium-sulfur (client registration required.) Not all of these bets will succeed, but by developing a multi-generational roadmap for its role in energy storage, BASF is positioning itself for long-term competitiveness, rather than constraining itself to the short-term, year-to-year thinking that in part doomed the Daimler-Evonik and SK-Continental partnerships.

Additional Analyst Insights available exclusively to Lux Research clients

Advanced Materials: Confronting the Innovation Vacuum in 3D Printer Quality Control

Agro Innovation: Failed Mediterranean Olive Harvest Foreshadows Potential Risks to Other Crops

Alternative Fuels: U.S. Ethanol Producers Hit Blend Wall, Shift to Biochemicals

Autonomous Systems 2.0: High-speed Wireless Data Transmission Underwater Changes the Game for Robots and Infrastructure

Bio-based Materials and Chemicals: Evolva Acquires Allylix for $61 Million, Acquisition Trend Continues

BioElectronics: Vivify Health's Latest Funding Round Underlines the Value of Health Care System Partnerships for mHealth Solution Developers

China Innovation: Shanghai Launches Roadmap to Adopt Building Information Modeling (BIM)

Efficient Building Systems: Bidgely's Partnership with TXU Energy Reveals Utilities' Continuing Appetite for Low-touch Energy Saving Tools

Exploration and Production: Megadeal Alert: Halliburton to Acquire Major Oilfield Services Company Baker Hughes

Food and Nutrition: Is Going Local a Wise Decision for a Food Manufacturer? Not Always

Printed, Flexible, and Organic Electronics: R2D2 Consortium Targets OLED Lighting Manufactuing, But Will Not Impact the Market Opportunities

Solar: China National Bluestar Acquiring REC Solar for $640 Million

Sustainable Building Materials: Modified Wood Producer Kebony Raises a $10 Million Round Targeted Towards International Expansion

Water: GLV Divests Pulp and Paper Business to Form Water-focused Ovivo Inc.