EPA Releases 2014 RIN Data, Uncovering the Truth About Cellulosic Biofuel Production

Last month the U.S. Environmental Protection Agency (EPA) released 2014 Renewable Identification Number (RIN) production data. The RIN is used by the EPA to track biofuel trading as a unique RIN is generated for each volume of biofuel that is produced. While RINs are not a commodity, there is a monetary value associated with RINs as an incentive for renewable fuel production. One RIN is equal to 1 gallon of ethanol equivalent, therefore fuels such as biodiesel generate 1.5 RINs per gallon and heating oil and renewable diesel generate 1.6 RINs per gallon and 1.7 RINs per gallon, respectively.

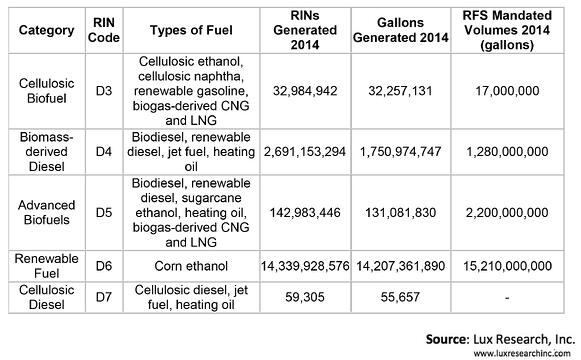

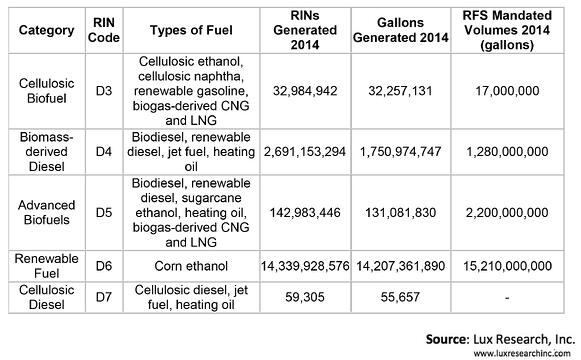

In total, 17.2 billion RINs were generated with 33.0 million RINs for cellulosic biofuel (D3). For the first time since the implementation of the D3 category in 2010, the mandated volume, revised to 17.0 million gallons in 2014, was met. In this insight, we will look at the five major categories of the Renewable Fuel Standard (RFS): Cellulosic Biofuel (D3), Biomass-Based Diesel (D4), Advanced Biofuel (D5), Renewable Fuel (D6), and Cellulosic Diesel (D7). Additionally, we will analyze the surge in D3 RIN generation in 2014 and its impact on cellulosic ethanol commercialization. First, we define each RIN category and describe the 2014 mandated volumes, as well as the number of RINs and gallons generated in 2014.

- Cellulosic Biofuels (D3). Though introduced into the RFS in 2010, cellulosic biofuels have faced the most scrutiny as lofty volume mandates were consistently missed, resulting in numerous revisions and reductions in volume. In 2012, the EPA went as far as removing the volume mandate for cellulosic biofuel (client registration required). In 2014, D3 production became a reality with nearly 33.0 million RINs generated. While the commercial operation of two major cellulosic ethanol facilities in the U.S., Abengoa (client registration required) and POET-DSM (client registration required), is a major step, it contributes a minor drop in the bucket as the EPA qualified biogas-derived CNG and LNG for D3 RINs in July 2014. We will take a more in-depth look at D3 generation in the second part of this insight.

- Biomass-based Diesel (D4). 2.7 billion D4 RINs, or 1.75 billion gallons, were generated in 2014, surpassing the mandated 1.28 billion gallons in 2014 in the RFS. Biodiesel makes up the majority of biomass-based diesel with major producers such as Archer Daniels Midland and Cargill. The U.S. remains the second largest biodiesel producer behind Europe, with a projected biodiesel capacity of 3.6 billion gallons in 2018 according to our Alternative Fuels Tracker (client registration required).

- Advanced Biofuels (D5). Many fuel types contribute to advanced biofuels, with 143.0 million RINs, or 131.1 million gallons, generated in 2014. More specifically, D5 RINs are generated from sugarcane ethanol, biodiesel production that co-processes renewable biomass, ethanol from non-cellulosic portions of crops, and biogas from waste digesters, amongst others. 90.3 million gallons were accounted for by sugarcane ethanol, with 20.4 million gallons from biogas, 11.9 million gallons from naphtha, and 8.4 million gallons from non-ester renewable diesel. Heating oil and renewable CNG made up the remaining volumes with 71,177 and 6,344 gallons, respectively. Companies such as Algenol Biofuels, Oberon Fuels, and Diamond Green Diesel (client registration required) all have certified pathways for D5 RIN generation.

- Renewable Fuel (D6). Renewable fuel is the largest RIN category, consisting of 14.3 billion RINs generated, or 14.2 billion gallons, that fell short of the revised 15.21 billion gallons mandated for 2014. D6 RINs are primarily first-generation corn ethanol and as mandate volumes push past the 10% blend wall limit (client registration required), there is little market pull for additional ethanol production as oversupply has become a recent phenomenon. However, led by the top five producers, Archer Daniels Midland, POET, Valero Energy, Green Plains Renewable Energy, and Flint Hills Resources, corn-ethanol production is projected to reach 15.6 billion gallons by 2018 according to our Alternative Fuels Tracker.

- Cellulosic Diesel (D7). Cellulosic diesel was the smallest category with only 59,305 D7 RINs generated in 2014. Cellulosic conversion to diesel still remains a niche market as the market continues to focus on converting cellulosic feedstock into ethanol. However, in November 2014 Ensyn received D7 approval for its Rapid Thermal Processing (RTP) technology that converts woody biomass into heating oil.

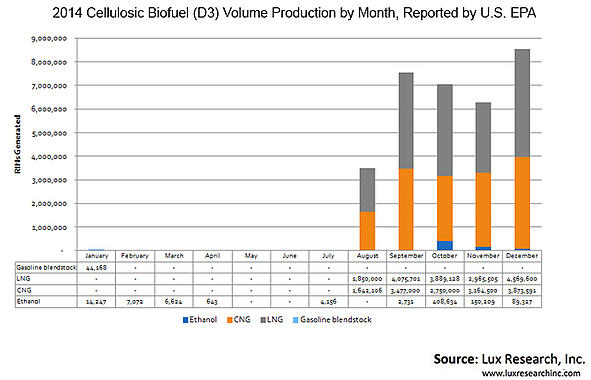

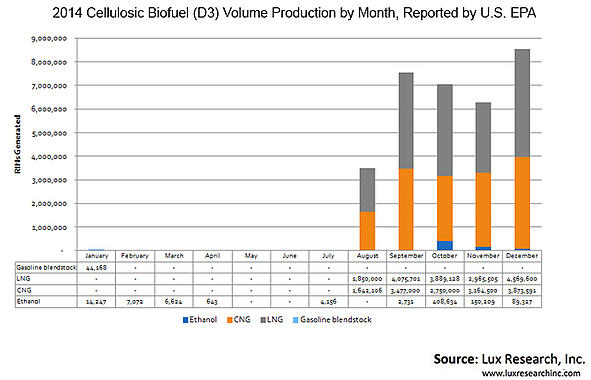

Given all of the attention on cellulosic biofuels, the D3 RIN numbers have received the most attention, and the below figure shows Cellulosic Biofuel (D3) production by month in 2014. While volume mandates were reached for the first time, we take a closer look at D3 data and uncover the reality of cellulosic biofuels in the U.S.

- A total of 683,643 gallons of cellulosic ethanol was produced in 2014, merely 2.1% of total D3 generation during the year. With major cellulosic ethanol projects coming online in 2014 there was an expectation for commercial scale production to occur; however, there appears to be major shortcomings. Looking at RIN data from December 2014, only 89,327 gallons of cellulosic ethanol were produced signifying a much slower initial ramp up of POET-DSM’s and Abengoa’s facility than expected which both began operations in September 2014 and October 2014, respectively. In the past we have seen major commercial facilities come online, only to disappoint with low production volumes. INEOS (client registration required) faced contamination issues in its syngas fermentation and KiOR’s (client registration required) biomass fluid catalytic cracking (BFCC) succumbed to technical issues as the company eventually filed for bankruptcy. While we do not expect either Abengoa or POET-DSM to have such a dramatic fall from grace, the production in 2014 leaves little room for optimism.

- 32.2 million gallons of renewable CNG and renewable LNG were produced in 2014 and these fuels are responsible for the high volume of D3 RINs in 2014. In July 2014, the EPA announced that biogas-derived CNG, LNG, and electricity (client registration required) for electric vehicles (EV) would qualify for D3 RINs as seen in the surge in the figure above. While we were previously skeptical about the ability of biogas to add significant volumes, it appears that it has not only achieved but surpassed the EPA’s expectations. Issues with biogas upgrading costs and fueling infrastructure for CNG and LNG will remain a major hurdle for widespread adoption (see the report "Modeling the Cost of Biomethane Production" -- client registration required), but the opportunities for fleet vehicles, both light duty and heavy duty, exist in 2015.

In 2015, it will be critical for existing cellulosic ethanol producers to prove its capability with actual production volumes. With the addition of DuPont Danisco’s facility in 2015 there will be 80 million gallons per year of nameplate capacity from the three major projects alone. In a time of low oil prices, it is even more critical for producers to strategically aggregate feedstock and reduce production cost (client registration required) (see the report "Quantifying Cost and Availability of Cellulosic Feedstocks for Biofuels and Biochemicals" -- client registration required). Companies such as Quad Country Corn Processors (QCCP) and Edeniq develop a bolt-on solution that may mitigate upstream barriers; however, it would only contribute a few million gallons per year of capacity. With uncertainty surrounding the RFS (client registration required), a lot of focus will be on newly proposed Cellulosic Biofuel (D3) mandate volumes. We will closely monitor additional data throughout 2015 to assess the viability of cellulosic ethanol production.

To read more insights from Lux Research analysts visit Lux Populi.