Contact Lux

Sustainable Building Materials and Efficient Building Systems

Team Leader

Senior Analyst

Aditya Ranade, Ph.D., MBA

Upcoming Sustainable Building Materials Webinar:

The Future of Construction: Influence of Megatrends Webinar

Wednesday, December 11, 2013 11:00 am EST

Register Now

Download Efficient Building Systems Webinar (previously recorded):

Big Money in Construction’s Big Data – the Convergence of Systems Integration & Performance in Buildings Download Now

Download Sustainability in Architectural Coatings Presentation Slides:

"Assessing Sustainability in Architectural Coatings"

This keynote presentation is from the European Coatings Congress in March, 2013. In this presentation, we develop a tool to assess the true sustainability value of established and emerging coatings technologies, and assess the sustainability value relative to their performance value to the end user. Download Now

Highlights From Lux Research

Sustainable Building Materials and Efficient Building Systems Intelligence Services

Digital Lumens Goes Beyond Lights: This Will be Powerful

Click here to learn what Digital Lumens is doing to give facility managers a single, integrated view of energy use and cost by system, enabling them to make better decisions about resource optimization and utilization.

U.K. Green Deal on Shaky Ground After First Nine Months

Read more about the Green Deal failures in the U.K. and how building code and utility regulations may have helped.

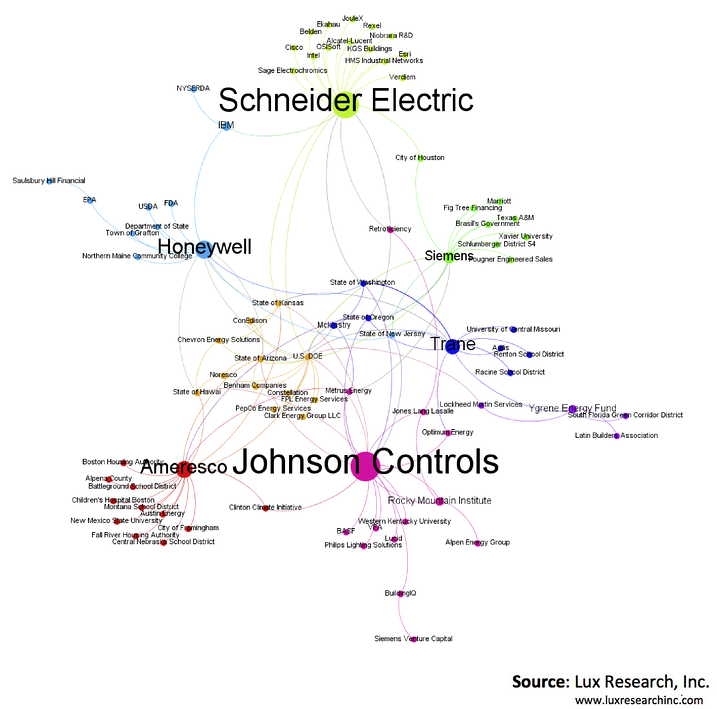

Schneider is building a building systems integration and IoT play. Schneider Electric has some notable partnerships in the U.S. market, which differentiate it from the competition. The company boasts several technology partners in the energy-IT space, such as Cisco and Intel. Digging deeper, we find relationships with Verdiem and JouleX (now part of Cisco), companies that target energy efficiency of IT infrastructure and networks. In the same vein, partner Belden specializes in signal transmission, and HMS Industrial Networks and Niobara R&D are both playing in the Internet of Things (IoT) and communication of industrial equipment. In addition, the company has engaged start-up KGS Buildings (client registration required) to build its energy analytics software to allow in-depth analysis of building data in well-instrumented buildings. From this focused network, it is clear Schneider is making a play both in building energy data analytics – which can be a strong ECM-identification tool in its own right – and in the industrial segment.

Johnson Controls leverages its facility management position. Separate from its ESCO business, Johnson Controls operates Johnson Controls Global Workplace Solutions (GWS), a facilities management services company, which operates real estate assets totaling more than 1.8 billion ft2 in more than 75 countries.i Perhaps predictably, Johnson Controls has connections with Jones Lang Lasalle (JLL), a leading real estate services provider. In addition to the highly visible, deep retrofit of the Empire State Building in New York City, which involved Johnson Controls and JLL, the two companies have cooperated to help drive retrofits as part of the leasing and building-out cycle in commercial buildings. In addition, the company has partnered with VFA, which provides a facilities management and capital planning software tool. VFA has worked with organizations like the U.S. General Services Authority’s Public Buildings Service, which is the largest real estate company in the U.S. Such a partnership allows Johnson Controls to dovetail capital planning with energy efficiency upgrades to form differentiation in its facilities management capabilities. Not only would GWS have the ability to identify retrofit opportunities, but it could deliver them with its ESCO capability. Johnson Controls has also engaged start-ups Retroficiency, Optimum Energy (client registration required), and most recently BuildingIQ (client registration required). The BuildingIQ partnership actually allows this energy data analytics software to be made available through Johnson Controls’ new Panoptix building automation system. Here Johnson Controls has leveraged not only its facilities management, but hardware business lines to deliver ESCO services.

Building materials companies left out in the cold. One conspicuous absence in the U.S. ESCO partnership landscape is that of building materials suppliers. The Johnson Controls-BASF link on the map is misleading, because it is not related to building materials but rather facilities management. There are two notable relationships, however: those of Schneider Electric and Sage Electrochromics (now a part of Saint-Gobain Group), and Johnson Controls’ connection to Alpen Energy (a part of Serious Energy). While Johnson Controls and Schneider have led the pack with their engagement of start-ups for data analysis and even hardware for systems, we have not yet seen significant deals with materials companies to facilitate envelope retrofit activities; these two partnerships touch only on glazing, leaving room for other building envelope solution providers.

To learn more about this graphic and related intelligence from Lux Research, click here or email Aditya Ranade.

i http://www.johnsoncontrols.com/content/us/en/products/globalworkplacesolutions.html